I don’t know if there are any implications around being acquired by a private equity firm, but what do you all think?

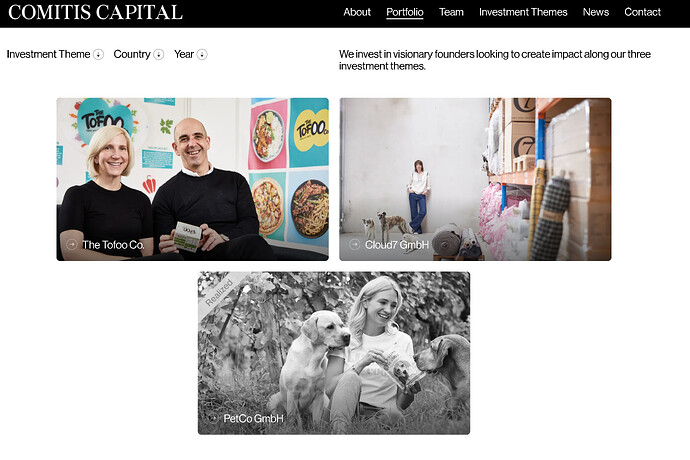

That buyer is pretty strange: tofu, pet food, ‘luxury’ stuff — and now Threema. I’m going to keep my distance, as I have so far.

Yeah, I think its fair to dismiss Threema just on principle seeing this, unlike how I tend to usually think about such things.

I agree but would also like to hear from any experts if there any actual technical implications to this :S

big oof.

I guess on Threema as a product it won’t have much changes since you have to pay money for it anyway, but i guess at some point they try to return some investment. Maybe we see premium features added behind a higher paywall than the 5 euro it cost currently, more marketing or changing up leadership.

I wouldn’t jump down the wagon, but i watch it with skepticism.

I believe this post is by a an employee:

They basically say Threema was purchased a long time ago, the founders left and its being actually bought by a smaller company now.

Open sourcing only happend after threema got acquired the first time. So they say not to worry

It’s not worth using even if they claim otherwise. You can easily find better alternatives.

What a way to shoot yourself in the foot, Threema. sigh

Guess Signal is truly the GOAT>

Yeah, Threema has been under private equity ownership for over 5 years. It’s some type of secondary buyout

In September 2020, Threema was acquired by AFINUM, a German private equity firm based in Munich.

In September 2024, CEO Martin Blatter and the remaining founders and original developers left the company and Robin Simon, a former executive from TX Group became CEO.

Anyway, their primary product is an enterprise solution, not a consumer-facing messaging app they peddle

big tofu strikes again

Most of the pre-Snowden encrypted instant messaging services are enterprise-focused now which is pretty sad.